On Nov 11, 2015 the National Assembly passed a Resolution on government budget in 2016. This included the implementation of a the Basic Wage adjustment from 1,150,000 VND/month to 1,210,000 VND/month effective May 1 2016 for government officers. In near future we expect the government will issue a new Decree to officially approve this increase.

If you have any questions, do not hesitate to contact HR2B Payroll Services in Vietnam.

See the Resolution in Vietnamese at the URL:

Effect

For government enterprises the Basic Wage is used to determine the salary of government workers. (Be careful not to confuse this with the "Minimum Regional Wage” which applies for private enterprise. See recent article here.)

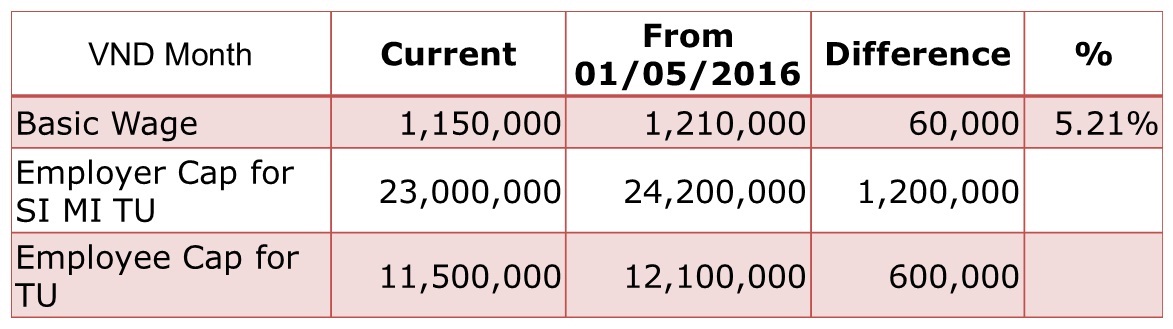

For all enterprises the Basic Wage is used to set the cap for employer and employee contributions to;

- Social insurance (SI)

- Medical insurance (MI)

- Trade Union (TU) - employer contribution only

The cap is 20 times the Basic Wage.

For Employee Trade Union (TU) contribution the cap is 10 times the Basic Wage.

Contribution Caps

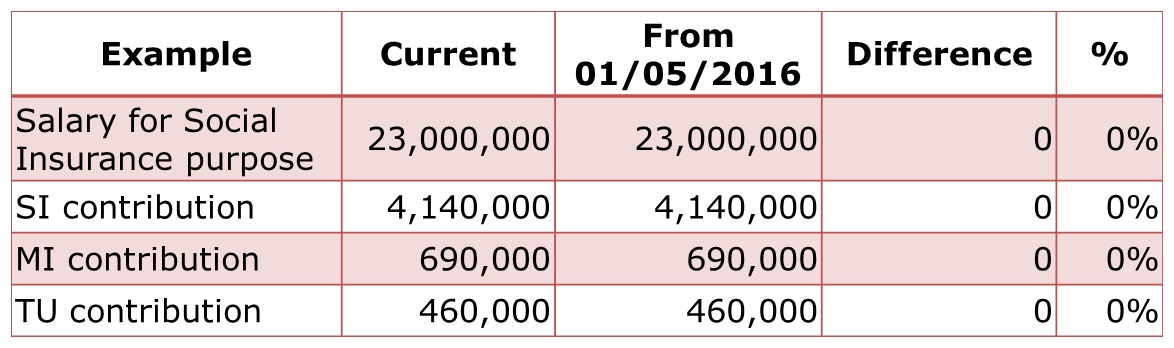

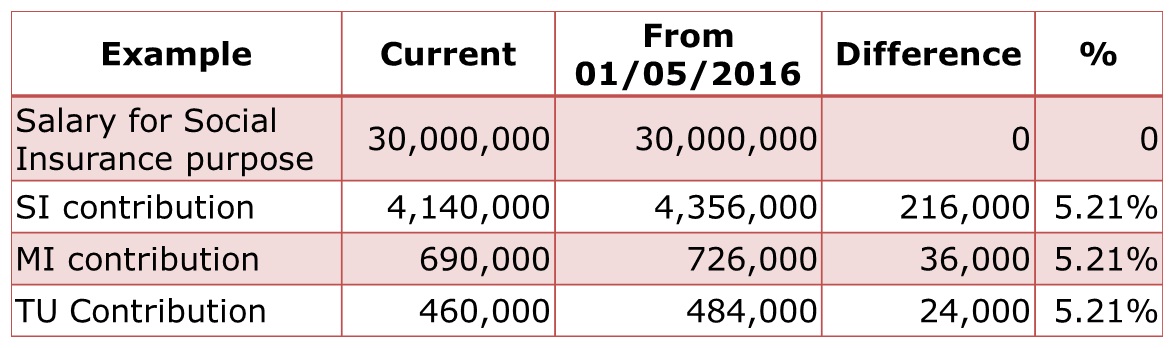

The employer and employee SI MI contributions will increase for people whose salary for Social Insurance purposes is more than 23,000,000 VND. This will decrease employees nett salary and increase employers cost to company.

The employee Trade Union contribution will increase for people whose salary for Social Insurance purposes is more than 11,500,000 VND. This will decrease employees nett salary.

Cost to Company

Where the employee Salary for Social Insurance purpose is less than current cap (23,000,000 VND) there is no increase in cost.

Where the employee Salary for Social Insurance purpose higher than current cap (23,000,000 VND) costs increase around 5%.

NOTE:- Unemployment Insurance cap is based on the Regional Minimum Wage.

Net Salary

Employees with Salary >23m VND will have around 5% higher SI MI employee deductions.

Employees with Salary >11.5m VND and belonging to the Trade Union will have to pay an extra 6,000 VND in TU fees.

HR Professional check list

- Calculate the extra "Cost to Company” for your payroll of this increase in the SI MI and TU cap.

- Optional - Identify inpiduals affected and calculate the reduction in their nett salary as a result of this change.

- Prepare a proposal for your board of directors / management to increase the salary budget from May 2016.

- Communicate the change to your affected staff.

- Check May 2016 payroll for compliance.

If you are the customer of HR2B, we are ready to help you for any query concerned to this matter and inform to you for your next action to make sure everything is done correctly and in accordance with law.

If you are not a client of HR2B, please call us to know HR2B can help you what and regularly update the latest changes of the regime of the law of Vietnam.

Uniting Talent

with

Opportunity

Uniting Talent

with

Opportunity

Top page